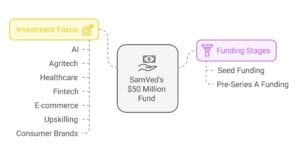

SamVed, a US-based venture capital firm, has announced the launch of a $50 million fund dedicated to investing in early-stage Indian startups. This fund aims to provide crucial seed and pre-Series A funding to innovative companies across diverse sectors, including AI, agritech, healthcare, fintech, e-commerce, upskilling, and consumer brands.

With a focus on providing early-stage capital, SamVed will invest between $80,000 and $120,000 in promising startups. This early-stage support will be complemented by invaluable operational assistance, including access to an in-house CTO and a vast global network. This holistic approach aims to equip startups with the necessary resources and expertise to navigate the challenges of early-stage growth.

Leading the charge at SamVed is a seasoned team of industry veterans. Amit Srivastava, a former investor at Bridgewater Associates, brings his deep financial expertise to the table. Joining him is Shanti Mohan, a renowned figure in the Indian startup ecosystem as a co-founder of LetsVenture. The team is further strengthened by the inclusion of Gagan Saksena, a former Google leader with a wealth of experience in technology and innovation.

The fund has already made its first moves, backing three promising startups. These include a company revolutionizing the food vendor industry, a provider of smart vending machines catering to tier-II and tier-III cities, and a software platform empowering the textile industry. These early investments demonstrate SamVed’s commitment to fostering innovation in sectors that directly impact the lives of India’s middle-income population.

“As a group, we have been co-investing for several years, and our goal has been that we want to think about economic opportunities in India Two,” shared the founders, highlighting their strategic vision. This focus on addressing the unique challenges and opportunities presented by India’s vast middle-income market sets SamVed apart.

The fund is currently targeting an initial close of $20 million by March 2024, which will provide a strong foundation for its investment activities. This initial capital will be crucial in accelerating support for promising ventures and driving their growth trajectories.

SamVed’s entry into the Indian startup ecosystem is poised to have a significant impact. With its experienced leadership, strategic focus, and commitment to providing comprehensive support, the fund is well-positioned to empower entrepreneurs and fuel innovation across the country. As the fund progresses towards its full corpus, its influence on the Indian startup landscape is expected to grow significantly.

Key Takeaways:

- SamVed launches a $50 million fund to invest in early-stage Indian startups.

- The fund targets sectors including AI, fintech, healthcare, and more.

- Investments will range from $80,000 to $120,000, along with operational support.

- The team boasts industry veterans from Bridgewater, LetsVenture, and Google.

- The fund has already backed three startups focused on sectors impacting the middle-income population.

- SamVed aims to play a crucial role in shaping India’s startup ecosystem.

SamVed’s launch of a $50 million fund signifies a significant commitment to the Indian startup ecosystem. By combining early-stage funding with operational support and access to global networks, the fund is well-positioned to help promising startups thrive and achieve their full potential. As the Indian startup ecosystem continues to evolve, SamVed’s investments will play a crucial role in driving innovation and fostering economic growth.

Subscribe:

Stay connected with the latest updates, exclusive insights, and curated content by subscribing to my newsletter.